Competition in the automotive industry is intensifying and brands are competing on more fronts than at any time in history. Of course, price, performance, brand, and residual values continue to be important. But as the industry gravitates toward electrification and software-defined vehicles, customers are looking at what else their vehicles can do for them. How well do they integrate with their lives and their digital ecosystems? Can and will the car evolve over time to add more value to daily life? And, for manufacturers, how do you build supply chain resilience and competitiveness to address these evolving demands, while ensuring availability and affordability?

Automakers – especially at the luxury and premium end of the market – are also intensifying their focus on providing assisted and autonomous driving capabilities and new ways to add value with digital experiences, inside and outside the vehicle. In the face of increased competition, the speed with which automakers are able to innovate and the extent to which they can engage and satisfy their customers in new ways will be crucial to future success or failure.

Autonomous mobility at the crossroads

For years, tech and innovation events like CES have been dominated by autonomous vehicles of all shapes and sizes. The technology is always impressive … at the shows. But, in the real world, progress has been slower than expected. For every success, it seems like there’s been at least one story of a scaled-back or canceled investment, an unfulfilled promise, or a serious safety scare.

The pursuit of autonomous mobility is a double-edged sword. The cost of adding sensors for 20+ detection zones around the car is significant. And the volumes of data, the sophistication of algorithms, and the amount of computing power required to develop, test, and validate systems are eye-watering. And yet, the ability to offer customers safe and stress-free ways to travel; to give back quality time while getting from A to B, is a once-in-a-lifetime opportunity to build trust and open the door to a whole new world of services and revenue streams. It’s no wonder the pursuit of the various certification levels is so intense and why so many companies are taking different routes – from in-house development with tech partners to major alliances with tier-1 suppliers, and even acquisitions. Some companies are making more progress than others, but the race is still wide open.

The in-car experience is evolving

The transition to electric and the pursuit of autonomous-driving capabilities have major implications for the automotive customer experience, especially the in-car digital experience. With electric vehicles, we know that recharging away from home will involve idle time. And – though it may still be a way off – autonomous mobility will allow us to focus less on driving the car and leave us more time to do other things. Today, our first thought might be to reach for our smartphones or tablets, but this is a lost opportunity for vehicle manufacturers.

And so the question becomes: How can your car keep you entertained and engaged while it charges or self-drives?

The answers are emerging in the form of expansive screens, adaptive interfaces, the addition of extra screens for passengers, an increasing emphasis on in-car gaming, content consumption, subscription services, and almost unlimited ways to pass the time productively, recreationally, or relaxingly in a vehicle.

And then there’s the potential to have an AI-powered assistant, or companion, that connects all the different services and is capable of providing pretty much any information you need about your journey, your agenda, upcoming commitments, highlights from your inbox or social media feed, and much more.

All of these features represent potential points of differentiation, and many of them are revenue-generating opportunities (e.g. subscription-based services). Beyond direct revenue and new levels of customer intimacy, in-car digital interactions also create opportunities to generate new data and insights, which can (with the right levels of consent and anonymity, of course) be used to shape new products and services – inside and outside the vehicle – and new monetization opportunities.

Speed and satisfaction – why they matter more than ever

You could argue that the evolutions I’ve explored above are technology trends, much like many others. However, these trends are different in that if you can achieve the combination of safe autonomous or highly assisted mobility and engage customers with compelling in-car experiences, you can gain a level of trust, and access – and even companionship – that is unprecedented in the history of OEM-customer relationships. This brings with it the opportunity to develop deeper, longer, and more lucrative relationships.

But the race for the hearts and minds of customers is intense, with a raft of new players (many from China) to compete against, new demographics, and rapidly evolving customer expectations. In this climate of increased competition, it is imperative that automotive companies intensify their innovation efforts in a bid to deliver the integrated and connected customer experience that will soon be taken for granted. And if your brand isn’t able to provide it, you can assume that another one will.

Balancing the need for speed and satisfaction with a ‘zero compromise’ approach to safety and security

Against this backdrop of ultra-intense competition and a relentless focus on innovation, OEMs must remain vigilant and understand that speed to market can never take priority over safety and security.

Assisted and autonomous mobility can offer comfortable, convenient, and stress-free travel. But they also mean taking a significant degree of responsibility for the safety of vehicle occupants. In short, ADAS and autonomous driving systems cannot fail. Failures will result in more than a few lost sales – they could lead to loss of life, high-profile court cases, and a complete loss of confidence in your brand.

And though it’s less likely to be a life-or-death matter, automotive brands need to be vigilant about ensuring the cybersecurity of their vehicles and data ecosystems. Digital assistance or companionship, subscriptions, services, integrated payment solutions and ecosystem services (e.g. via wearable health devices, smartphones, etc.) will typically require some degree of data sharing. This opens the door for personalization and seamlessly convenient experiences, but it’s not without its risks. No brand wants to be the next one to appear in a high-profile data leak story and risk losing the hard-earned trust of its customers.

Software is the key to safe, secure, and satisfying experiences

So what’s the key to accelerating innovation cycles and customer satisfaction without compromising on safety and data security?

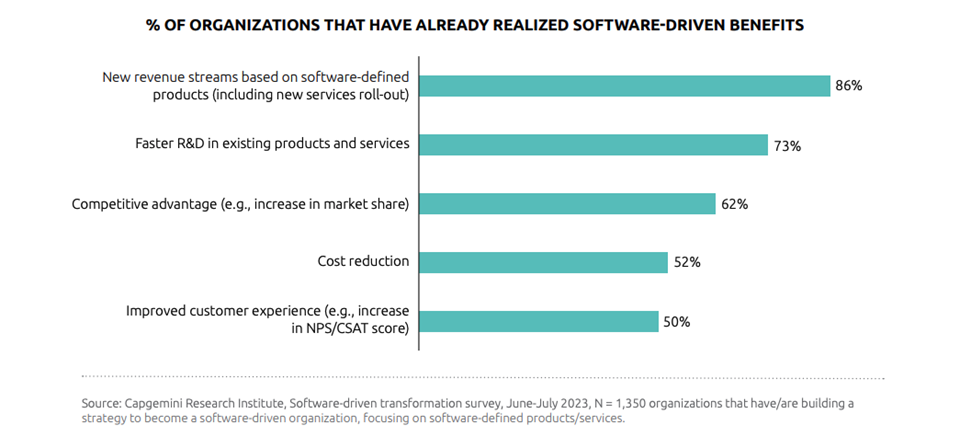

The answer lies in your software strategy. After all, software is at the heart of assisted and autonomous driving systems, it drives immersive and engaging digital experiences through infotainment systems and more, and it can be the key to ensuring the security of personal data and the identification and elimination of sophisticated cybersecurity threats. The right software strategy and architecture (i.e. a simplified one) can also provide you with greater flexibility during times of supply chain instability, meaning you can maintain product availability while your competition potentially suffers. As many of us learned during the pandemic, simply making sure your cars are available to potential buyers can be the biggest advantage of all.

But the stakes are too high with software and the task of transforming into a software company is too big to go it alone. Here are three ways automotive companies can get their transformation right.

1. Partner up to boost software capabilities

Software-driven transformation is a broad and deep-reaching process, which can encompass upskilling your existing team, building new capabilities, and finding the right balance between maintaining your existing digital products and developing new ones. This is a huge undertaking, and so it makes sense to partner up with automotive software specialists and engineers who can share and instill industry best practices, build dedicated software factories for you, or support you in maintaining existing products or developing new ones.

2. Use cloud, virtualization, and AI to achieve more

Cloud and AI can be used to process and analyze the high volumes of data produced during autonomous driving system development and testing, to virtualize ECUs, and to support data spaces and service ecosystems. These technologies, combined with the suite of automotive-specific accelerators being built by hyperscalers today, can supercharge your innovation and product development cycles, enabling you to get to market faster with new products and services, while keeping your – and your customers’ – valuable data secure.

3. Look for external inspiration

Automotive companies can’t be everything to everybody. It’s difficult (impossible?) to develop an infotainment UX that rivals that of smartphone makers like Apple and Google if it’s not your core business. Likewise, you won’t suddenly create ‘killer’ content and entertainment options if you’re just starting out. Instead, partner up with startups and niche players in differentiating domains and focus on the bigger picture.

The road ahead is filled with complexity and exciting developments. And yet, for all the focus on new technology, there are still large groups of customers who care little for new tech, and who continue to value practicality, build quality, and affordability above all else. How organizations address these oft-divergent customer desires within their product portfolio will be a challenge for many ‘traditional’ OEMs.

What we can say with confidence is that mobility experiences of the future – whether they’re autonomous or human-driven – must be satisfying, safe, and secure. Automotive companies must be quick to give their customers what they want. Check out our perspective on software in automotive to learn more.