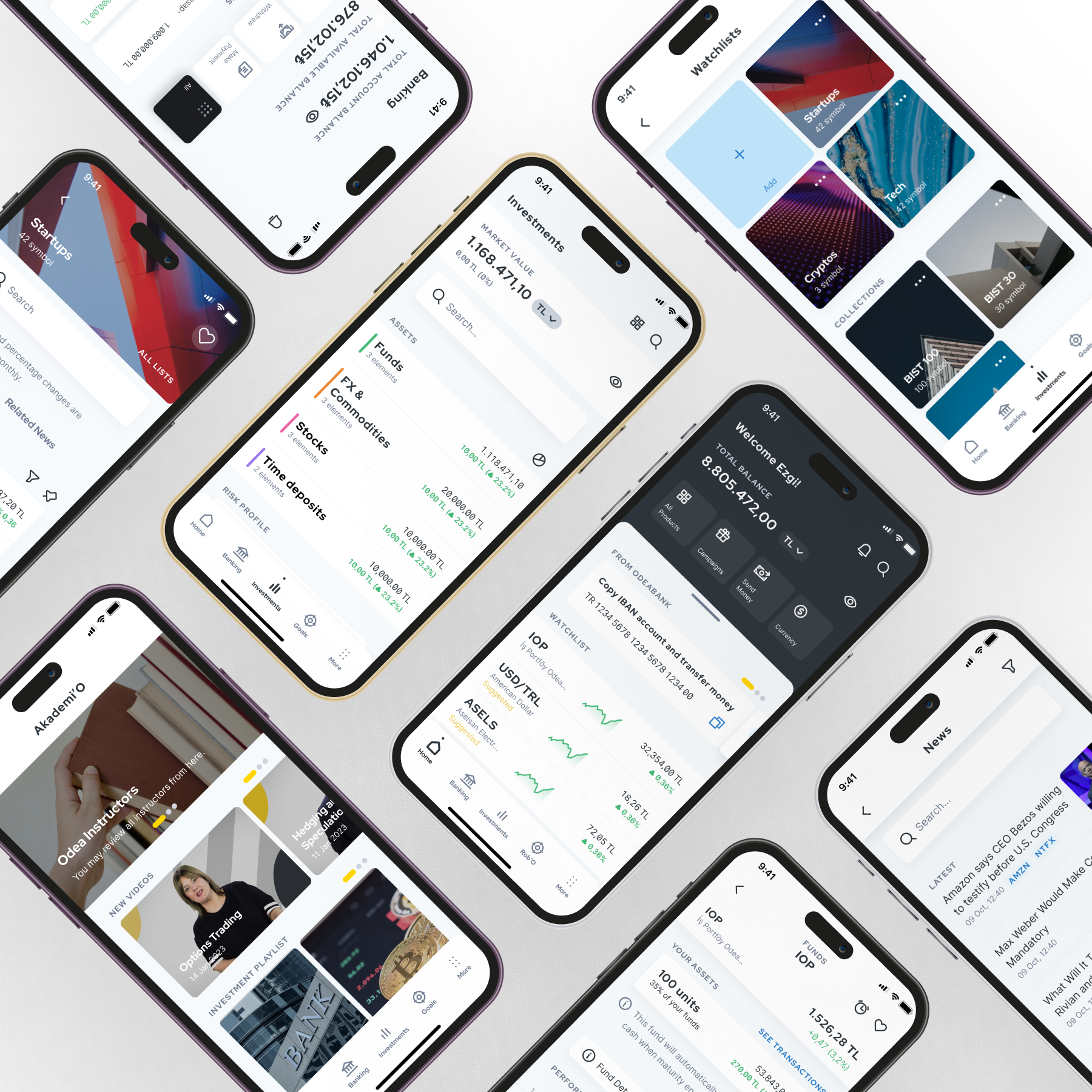

Banks and capital markets firms are facing unprecedented disruption. While reducing costs is critical, they must also invest in digital banking transformation to meet customers’ evolving digital expectations, manage risks, and attain sustainable business practices. As the industry adapts, firms need to create customer-centric business models and deliver personalized experiences to meet changing demands.

We partner with top global financial institutions, including 8 of the top 15 banks and 9 of the top 15 diversified financial companies, to drive digital transformation that aligns with business objectives. By reimagining traditional banking models, we help firms become data-driven enterprises that can swiftly respond to market shifts, build stronger relationships with partners, and remain compliant with evolving regulatory requirements.

For capital markets firms, the need to reduce operational costs and improve trade efficiencies while maintaining compliance with regulatory demands is paramount. Our expertise in banking IT services helps firms adopt robust digital infrastructures that streamline processes, improve data management, and foster innovation. We offer comprehensive solutions that empower capital markets firms to navigate the complexities of their industry with confidence, ensuring long-term resilience and operational excellence.